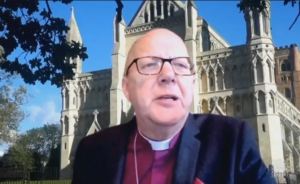

On 19th April 2021, during a debate on the Financial Services Bill, the Bishop of St Albans spoke in support of two amendments tabled by Lord Sikka, outlining the need for greater transparency around ministerial interventions in cases of financial misconduct, and supporting the establishment of a supervisory board to strengthen the accountability of financial watchdogs:

The Lord Bishop of St Albans [V]: My Lords, I will be brief in my support for this amendment. I am very grateful to the noble Lord, Lord Sikka, and the noble Baroness, Lady Bennett of Manor Castle, for speaking at great length. I therefore do not need to add a huge amount more, not least as I intend to go into a bit more detail on my concerns about transparency when speaking in support of Amendment 34, which touches on similar issues of accountability.

I am a little puzzled why the noble Baroness, Lady Neville-Rolfe, thinks that this is a case of bad cases making bad laws. It seems to me that there have been very considerable concerns in the past. Surely those ought to be investigated.

We are facing a real crisis of trust in public bodies at the moment, and I believe that this amendment will be a beneficial addition to this Financial Services Bill. In making provisions for an additional layer of transparency, it will act as an incentive against any possible interference; whether done formally or informally, it will still have that effect. The truth is that we do not know whether ministerial interference in FCA investigations has occurred, and positively stating either way is speculative.

Although I was not privy to the written response from the noble Earl, Lord Howe, which he promised to send to the noble Baroness, Lady Kramer, confirming whether there were provisions within the Ministerial Code to allow for interventions in FCA investigations, the assumption in Committee was that any attempt to steer an FCA investigation would constitute a breach of the Ministerial Code. That would require breaches of the Ministerial Code or other offences to be taken seriously, and not treated lightly or even dismissed. Last year, an inquiry found evidence that the Home Secretary had breached the Ministerial Code, yet the consequences extended little further than an apology. In February, it was revealed that the Health Secretary had acted unlawfully when his department failed to reveal details of contracts signed during the Covid-19 period. Just before Easter, we all started reading about allegations surrounding conflicts of interest in a former Prime Minister’s dealings with the financial services firm Greensill, and there have been concerns about the current Prime Minister’s dealings during his time at City Hall. It is vital that, if we are to rely on breaches of the Ministerial Code, they are given some teeth and have some effect.

I have no evidence, but it may be that no Minister has ever interfered in any FCA investigation, in any way. I sincerely hope that that is the case, but we cannot rule it out. If interferences have occurred, it would be doubtful to assume that investigations are always steered in the interests of consumers. Although provisions are in place to prevent misconduct, they should not discount the contribution that this important amendment can make in strengthening those rules and further disincentivising any possible ministerial interferences in FCA investigations. If Her Majesty’s Government have concerns about small parts of the wording here, I hope they come back with some improvements to ensure that the levels of transparency are clear to everybody, in every part of the system.

The Bishop of St Albans [V]: My Lords, I will speak in support of Amendment 34, in the name of the noble Lord, Lord Sikka, which is an interesting contribution to the question of governance. I am keen that we find any ways that we can to speak into those organisational cultures that every industry adopts and promotes, and which sometimes lead to groupthink.

There are times when it takes someone from the outside to ask intelligent questions. I am reminded of Her Majesty the Queen asking the Bank of England why there had been a financial crash back in 2008, when many people in the industry, who were paid extraordinary amounts of money because of their supposed expertise, had not spotted that it was coming. I do not think that this is about inviting people who are ignorant to come on to boards; this is a question about whether there is a wider contribution that might be very useful and of help to thinking about issues of governance responsibility.

I will comment briefly on a further development in the FCA’s investigation into car finance, which I have referred to in the House in the past. Since the FCA introduced its new rules banning discretionary commission models in January 2021 and subsequently closed its investigations into Lookers, the car dealership firm, for possible mis-selling, it was revealed that the UK’s accounting watchdog, the Financial Reporting Council, was investigating accounting giant Deloitte for its role in auditing the very same Lookers that the FCA had

only just ended its investigation into a few weeks earlier. The FCA never confirmed or dismissed whether there had been any mis-selling, remarking that it had made its concerns clear and did not intend to impose penalties on this FTSE 250 firm. However, the opening of a new investigation relating to Lookers raises questions about the thoroughness of the original FCA investigation: were all aspects investigated?

The introduction of a supervisory board with the statutory functions set out by this amendment—able to scrutinise the FCA and PRA’s decisions where it is reasonable to seek an explanation, such as in the case of Lookers—is an interesting idea that we ought to think about. This would not only strengthen accountability but provide the FCA with a chance to explain its responses and relay any concerns, whether they are structural or to do with resourcing. Where its investigations are delayed or prematurely completed without any subsequent action, the danger is that some may be tempted to think something is being hidden.

The FCA has been criticised during these proceedings and some of those criticisms have been justified. Other Members of the House have pointed out that this is a huge area, where there will always be some problems and they are to be expected. However, a lack of regular communication between the FCA and parliamentarians certainly does not help. If there are internal problems in the FCA that contribute to what some feel is a lack of enforcement, I am sure they and many others would be interested in hearing about this.

Through the annual report provided by this supervisory body, a better understanding of the problems within the FCA, and justifications where action has not been taken, could be facilitated. This would lead to more robust and accountable financial service regulators. This amendment, with its limited oversight and non-interference in running operations, could refine our financial services regulators over time to better undertake their functions and enhance communications between them and parliamentarians.

Any efforts to increase transparency and accountability are always welcome. I hope that the Government will reflect on this short debate and, if these are not the particular ways to enhance our financial regulators, come up with other ideas and resources so that we can work out how to be more effective in this vital area as we look to build a national and international reputation for these services.

You must be logged in to post a comment.