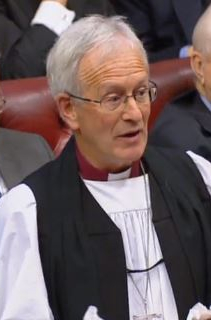

On 21st March 2023, the House of Lords debated the Financial Services and Markets Bill in committee. The Archbishop of Canterbury spoke in support of amendments tabled by Baroness Kramer which stressed the importance of the lessons learned from the 2008 financial crash:

The Lord Archbishop of Canterbury: My Lords, I have added my name to Amendments 241C and 241D tabled by the noble Baroness, Lady Kramer, and wish to speak briefly in support of them here. I am particularly grateful to the noble Baroness, Lady Noakes, who made some very helpful and powerful points.

As the noble Baroness, Lady Kramer, said, this marks 10 years since the publication of the Changing Banking for Good report from the parliamentary commission, on which I sat with her. The two amendments to which I have added my name are probing amendments to stress the importance of not forgetting the lessons of 2008-09, because people and sectors entirely can have very short memories.

As the noble Baroness has explained, the amendments seek to prevent alteration to two elements of the banking reform Act 2013 by statutory instrument without proper debate in Parliament, and to prevent changes which go against the recommendations of the parliamentary commission. Our memories have certainly been refreshed this week. If the debate on this group had been held when it was first scheduled two or three weeks ago, I think we would have had a very different reception. If one is grateful for anything in the present crisis, it is that we have been so warmly reminded of why we need a clear memory.

Continue reading “Financial Services and Markets Bill: Archbishop of Canterbury supports amendments on financial safety”

The Lord Bishop of St Albans: To ask Her Majesty’s Government what assessment they have made of the relationship between HSBC Bank and the Chinese Communist Party. [HL11375]

The Lord Bishop of St Albans: To ask Her Majesty’s Government what assessment they have made of the relationship between HSBC Bank and the Chinese Communist Party. [HL11375] On 3rd September 2019 the Bishop of St Albans

On 3rd September 2019 the Bishop of St Albans

You must be logged in to post a comment.