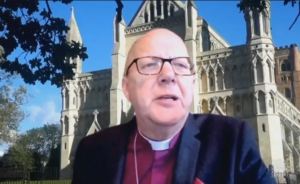

On 19th April 2021, during a debate on the Financial Services Bill, the Bishop of St Albans spoke in support of two amendments tabled by Lord Sikka, outlining the need for greater transparency around ministerial interventions in cases of financial misconduct, and supporting the establishment of a supervisory board to strengthen the accountability of financial watchdogs:

The Lord Bishop of St Albans [V]: My Lords, I will be brief in my support for this amendment. I am very grateful to the noble Lord, Lord Sikka, and the noble Baroness, Lady Bennett of Manor Castle, for speaking at great length. I therefore do not need to add a huge amount more, not least as I intend to go into a bit more detail on my concerns about transparency when speaking in support of Amendment 34, which touches on similar issues of accountability.

I am a little puzzled why the noble Baroness, Lady Neville-Rolfe, thinks that this is a case of bad cases making bad laws. It seems to me that there have been very considerable concerns in the past. Surely those ought to be investigated.

Continue reading “Financial Services Bill: Bishop of St Albans supports amendments on transparency and statutory governance”

You must be logged in to post a comment.