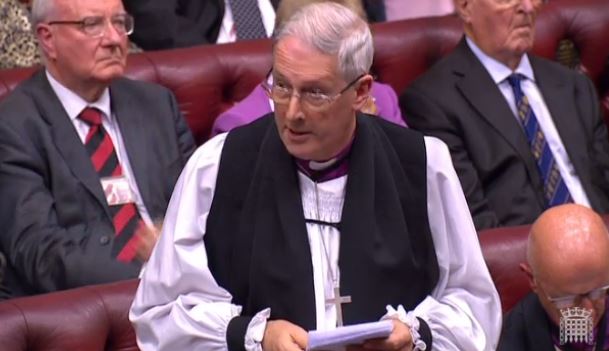

“Employers who have already adopted a living wage policy have lifted thousands of people out of working poverty. They are not claiming tax credits because they have been lifted out. The Exchequer could gain up to £4.2 billion a year in increased tax revenues and reduced expenditure on tax credits. That is a much neater way of doing it.“- Archbishop of York, 26/10/15

On 26th October 2015 the House of Lords debated a motion to approve the Government’s Tax Credits (Income Thresholds and Determination of Rates) (Amendment) Regulations 2015.

On 26th October 2015 the House of Lords debated a motion to approve the Government’s Tax Credits (Income Thresholds and Determination of Rates) (Amendment) Regulations 2015.

Alongside the motion to approve the House also debated four amendments to the motion, from Liberal Democrat, Crossbench and Labour Peers and one from the Bishop of Portsmouth, Rt Rev Christopher Foster. Continue reading “Archbishop of York speaks against Government proposals on tax credits”

On 26th October 2015 the House of Lords debated a motion to approve the Government’s Tax Credits (Income Thresholds and Determination of Rates) (Amendment) Regulations 2015.

On 26th October 2015 the House of Lords debated a motion to approve the Government’s Tax Credits (Income Thresholds and Determination of Rates) (Amendment) Regulations 2015.

You must be logged in to post a comment.