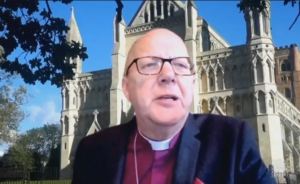

On 10th January 2023, the House of Lords debated the Financial Services and Markets Bill in it’s second reading. The Archbishop of Canterbury spoke in the debate, highlighting the need for good practice and quality of service in the finance industry:

The Lord Archbishop of Canterbury: My Lords, this year marks the 10th anniversary of the final report of the Parliamentary Commission on Banking Standards, Changing Banking for Good. I declare my interest having served on that commission, and I welcome the presence in this debate of the noble Baroness, Lady Kramer, who also served, as did the current Lord Speaker. I also welcome the maiden speeches of three noble Lords today: the noble Lords, Lord Ashcombe and Lord Remnant, and the noble Baroness, Lady Lawlor.

We need to remember that the extraordinary crisis in 2008—which led to the various commissions, reports and changes in regulations, including the financial services Act 2013, in which the Parliamentary Commission on Banking Standards played a part—caused huge and ongoing crises. While welcoming the Bill very strongly, I join some of the hesitations mentioned by the noble Lords, Lord Hunt, Lord Sharkey and Lord Vaux. It has been estimated that the financial services industry, and particularly the major banks, have an effective subsidy as a result of the implicit government guarantee that they receive, which is worth approximately £30 billion a year. If there is £30 billion a year going spare, many other industries and not a few churches would welcome that very warmly. However, that subsidy, which is at the risk of the taxpayer, as we saw in 2008 and 2009, is what gives the result of the banks having heavy social obligations; we must look carefully at that when the Bill reaches Committee, as has already been said. The issues of inclusion, stability and access at all levels, especially for micro-businesses, are very important, not least for levelling up.

Continue reading “Financial Services and Markets Bill: Archbishop of Canterbury stresses importance of serving the common good”

You must be logged in to post a comment.